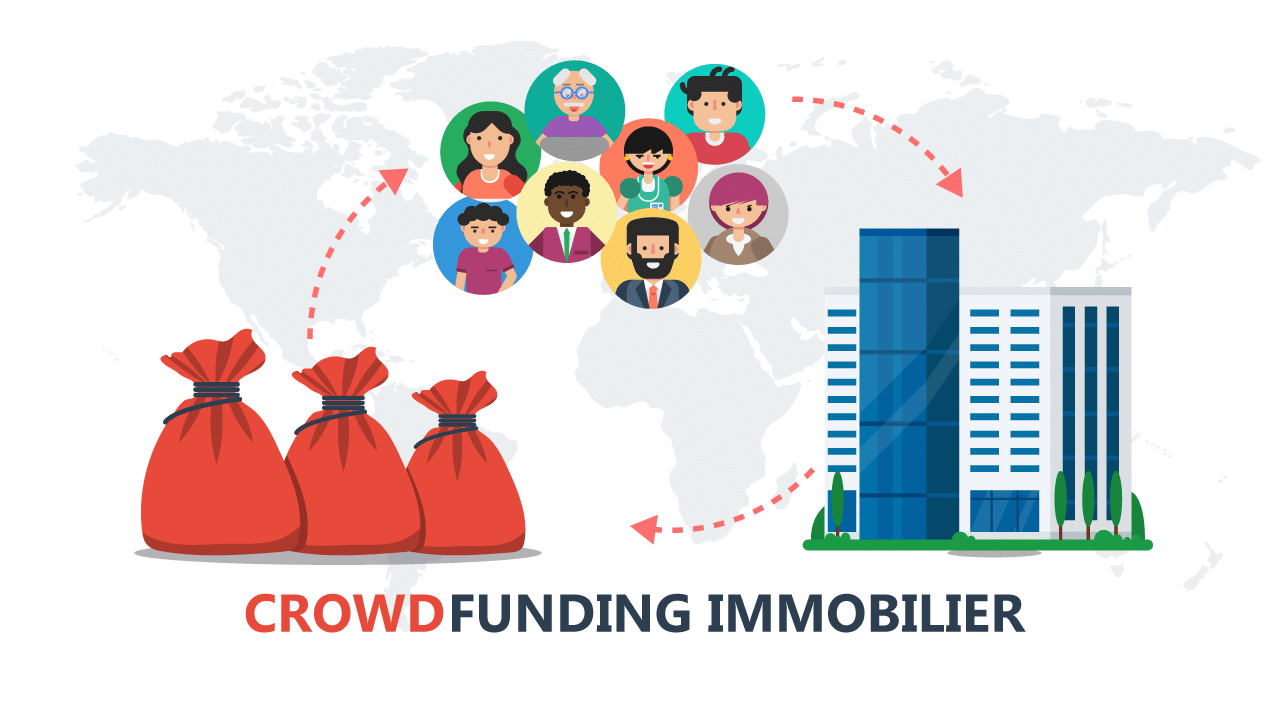

Crowdfunding, also called participatory financing, is a method of fundraising, carried out via an online platform and which allows several people to collectively finance identified projects. It is a program that is within reach of all budgets. Indeed, in countries with a dominant economy, it is a method that far promotes economic progress. And the system is especially encouraged to boost lagging markets . How does it work in real estate? What are the benefits and risks involved? We give you these explanations in this article.

Definition of real estate crowdfunding

Real estate crowdfunding is a process for raising funds to build or acquire real estate, through a 100% online platform. It is indeed an operation that consists of participating in the acquisition of real estate by buying a share. It is a collective turnkey real estate, which generally happens to be a real estate construction project in progress.

The real estate crowdfunding mechanism

Highly developed in European countries, crowdfunding is a kind of investment in Real Estate Investment Trusts (REITs). Thus, the promoter must ensure that the investors are gathered and ready before embarking on the procedures, in particular the application for a permit, the start of the work on the foundation of the building, etc.

It should be noted, however, that it is the project leader who will finance part of the program while appealing to private investors, who will lend him money for a period. In return, the promoter guarantees them a repayment of their capital on a fixed date and promises a possible profit. This process makes it possible to finance different types of real estate transactions such as the purchase or construction of real estate.

Difference between Real Estate Investment Trusts (REITs) and real estate crowdfunding

A Real Estate Investment Trusts (REITs) is a specialized fund that is invested in a rental property. It is therefore a question of investing in real estate intended for rental (in particular offices, real estate, etc.). As a result, investors who have acquired shares in an SCPI receive income from rents on a quarterly basis.

Conversely, real estate crowdfunding allows you to invest in the construction of real estate. The investor is therefore not the owner, but the creditor. In addition, it is he who chooses the projects that interest him (unlike for an REITs where investors have no role in the choice of the selected real estate).

The benefits of real estate crowdfunding

Crowdfunding has enormous potential. By allowing the project leader to strengthen its own funds thanks to funds from private investors, real estate crowdfunding opens up new development prospects. In addition, it is an investment within the reach of all budgets. This assumes that even low-income households can invest. However, this does not prevent major investors who have the ambition to diversify their assets from participating.

Optimal performance

Depending on the property being invested in and the investment company, crowdfunding would offer a high annual interest rate of up to around 10%. Note however that, like any real estate project, real estate crowdfunding is a long-term project. In most cases, the initial capital invested is only recovered after an average of two years.

A shared investment

It is a shared investment because the participants invest only relatively small sums in a share. The risks are also minimized due to the fact that several people are involved in the investment.

In addition, by using a bank loan to finance your investment in real estate crowdfunding, you systematically insure the latter in a way.

A booming market

Crowdfunding is a booming market. In the countries where it exists, it is on the rise. In addition, the public authorities encourage the sector for a more efficient development of the latter. In France, for example, the sector is supported by the government through laws and has a bright future ahead of it, according to some economic experts.

Real estate crowdfunding: How to invest?

The real question that arises after having appropriated the concept of real estate crowdfunding is how to invest? This part will be of interest to those who want to know the technical operation of investing in crowdfunding. To this end, there are two ways to invest in real estate crowdfunding, directly or via a bond issue.

Directly, investors hold shares in an SCCV (civil construction sale company) and therefore become shareholders alongside the promoter. They will have their shares redeemed with a capital gain, the ceiling of which is fixed in advance. It should be noted that in practice the investment will be made via an SAS which will invest in the SCCV (for regulatory reasons);

Through a bond issue, investors lend money to the SCCV, which will be in charge of the project. The bond will have an interest rate and a maturity (duration of the loan).

At first glance, these two ways are different. A bond is a debt contracted by the borrower with a duration and an interest rate defined in advance. On the contrary, an investment in units or shares makes you a shareholder without any return or horizon being defined.

In fact they are quite close. Indeed the shares or shares will be bought by the promoter at the end of the project under conditions fixed beforehand (X% per year). As for the bonds, they will be of the “in fine” type, which means that they will not be amortized over the duration of the project but will be repaid in full at the end of the project (interest included).

An online investment via an SAS

To make your investment a reality, you must go through a professional who will be the intermediary between you and the property developers. For this, it is advisable to go through the Simplified Public Limited Companies (SAS) which are experts in the field. They are renowned for offering simple and quality support to their customers. The presence of SAS online further facilitates the realization of your investments in real estate crowdfunding.

Expected returns

This is the most interesting part for investors and it is at the same time the big advantage of real estate platforms. Indeed, the expected gains can range from 9 to 10% per year, for a period of 9 to 24 months. Difficult to resist when we compare with the low profitability offered by savings books or euro funds.

Interest begins to accrue from the date of the effective issue of the bonds, i.e. generally 12 business days after the end of the subscription period. They end when the promoter repays the loan. It should also be noted that the minimum investment is generally set from 1000 Euros.

Limit the risks of real estate crowdfunding

Of course, real estate crowdfunding has enormous potential. It is indeed one of the most profitable sectors today. However, as in any investment, there are risks: unexpected bankruptcies, lack of liquidity of promoters, etc. What would be wise is to work to minimize them. To do this, here are some tips for you.

Sensitive choice of investment platform

Above all, you must make sure that the establishment offering you real estate crowdfunding has the necessary authorizations. Indeed, choosing a good real estate crowdfunding platform is the guarantee of investing in serious and solid projects, which considerably reduces the risk. Thus, do not rely entirely on your instincts when choosing the investment platform. Take an interest in the know-how of the teams making up the company in order to assess their degree of appetite and competence for this type of project. Their reputation, the number of years of experience, their expertise will be your selection criteria.

Finding the right market and real estate segment

Before investing, you should consider market trends. By doing so, you will then know the most buoyant sub-sector over time while taking into account your geographical location. Knowing the needs of the environment will undoubtedly allow you to better decide. In addition, it is advisable to ask yourself the following questions to ensure the feasibility of the project and to limit any risks.

Ask yourself:

Is there a demand for this type of property?

Is the construction of good quality?

Are the goods at market price?

The answer to these questions will be of great use to you.

Be well informed before investing

It is essential to be well informed before starting. You must necessarily inform yourself about all the news relating to your investment. Make sure, among other things, of the feasibility of the project, the seriousness of the promoter, etc.

Above all, don’t put all the eggs in one basket: diversify as much as possible by investing in different projects and on several platforms.

Real estate crowdfunding is a method of collective investment that deserves our attention. Notice to investors.